Checking

Everyday banking, made simple & free.

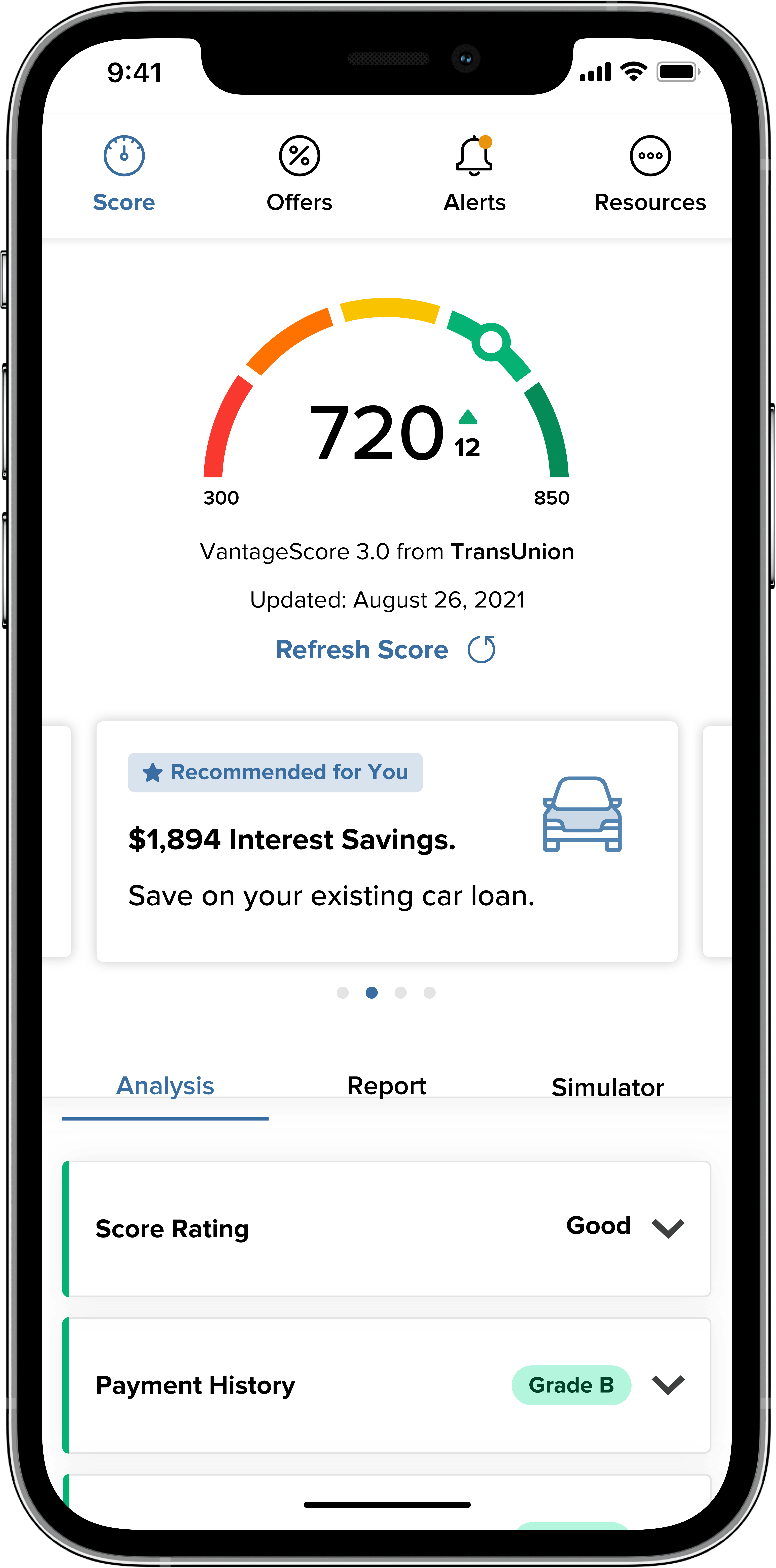

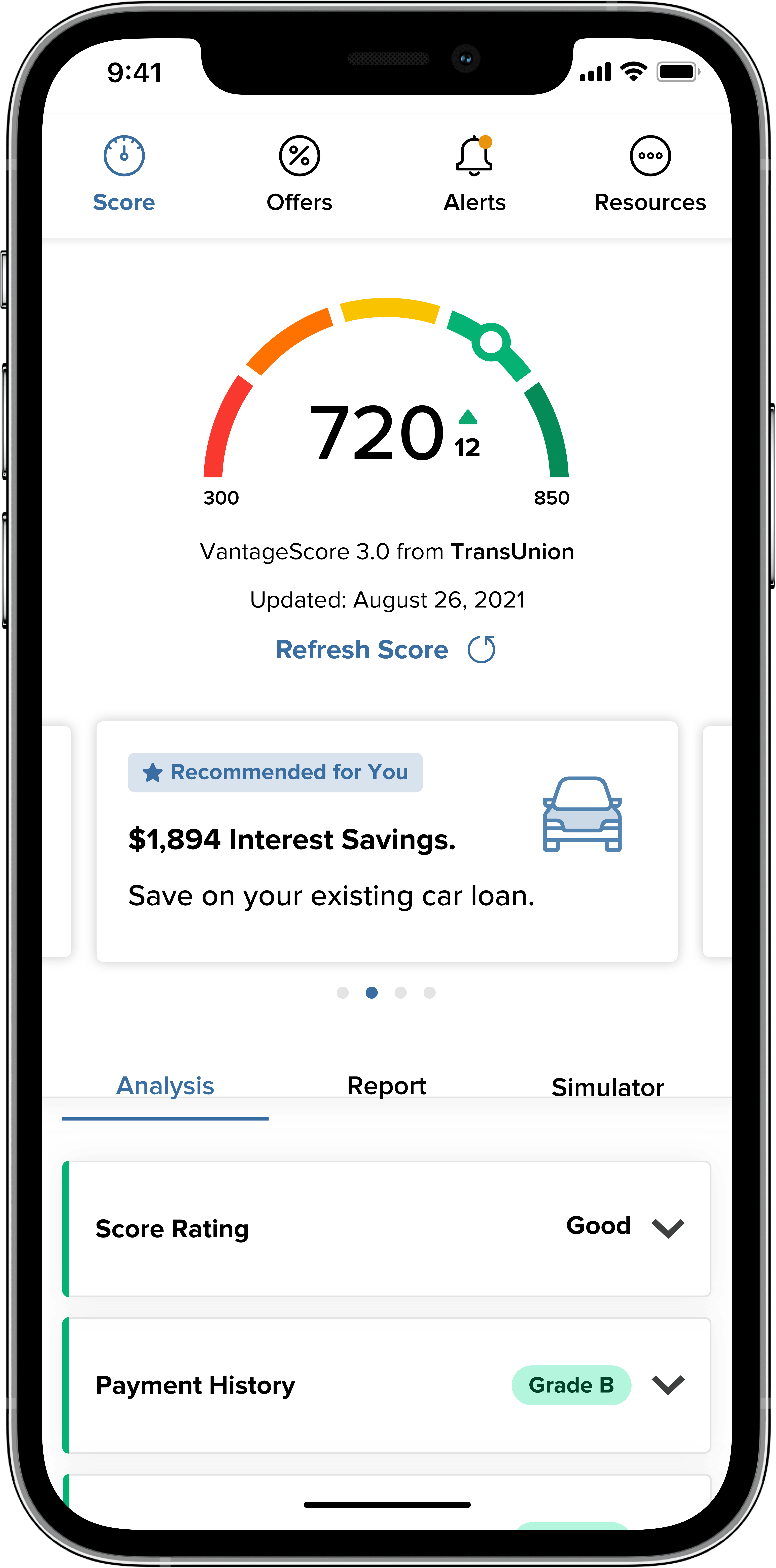

Staying on top of your credit has never been easier. With City & County Credit Union’s FREE credit score tool – SavvyMoney, you can access your credit score, full credit report, credit monitoring, financial tips & so much more! You can do all of this anytime and anywhere, without impacting your score.

To get started with SavvyMoney, log in to your mobile app and select 'My Credit Score' from the menu. Within Online Banking go to the Online Services tab and select 'My Credit Score'. You will be prompted for a one-time opt in before you can access the tool.

If you have yet to enroll in mobile or online banking, follow our quick enrollment options to get started.

The score that is provided in SavvyMoney is not the FICO score, but it will be close to your FICO score. Both scores use consumer credit data to generate a credit score, but they use different methods to calculate the score. This may result in slight scoring differences. The two scoring models are FICO and VantageScore. SavvyMoney uses VantageScore.

Credit scores are updated weekly. You will receive an email from SavvyMoney every time your score has been updated. You are able to opt-out from receiving these emails at any time.

There are five categories used to calculate your score and each has a different weight in making up your credit score.

No. You are able to check your credit score daily or as often as you would like without it affecting your score. Checking your credit score in SavvyMoney is considered a soft inquiry, which does not affect it.

Members will only be eligible to use SavvyMoney if they are 18 or older. If a member hasn’t borrowed before, or has a very thin file, either a low credit score will be shown or no score at all. They are still 100% eligible to opt-in and can use SavvyMoney as a financial education tool.

The score displayed in digital banking is for the primary individual on the membership only.